Australia 2025 Travel Insights

Wyatt Russo, CFA

December 8, 2025

December 8, 2025

“Here in Australia, we do get impacted by global economic events. But we should have some confidence that our economy has got strong underlying fundamentals.”

– Julia Gillard, Former Prime Minister of Australia

– Julia Gillard, Former Prime Minister of Australia

As we settle back in the United States following our latest research trip to Melbourne and Sydney, we can’t help but think fondly of our time Down Under. Our aim is to give clients a feel for what it is like on the ground, and the following description from Bill Bryson’s In a Sunburned Country has us nodding in agreement: “The people are immensely likable – cheerful, extrovert, quick-witted, and unfailingly obliging. Their cities are safe and clean and nearly always built on water. They have a society that is prosperous, well ordered, and instinctively egalitarian. The food is excellent. The beer is cold. The sun nearly always shines. There is coffee on every corner. Life doesn’t get much better than this.” This positive attitude permeated throughout both our meetings with management teams and our interactions with locals. We met with companies across banking, mining, healthcare, insurance, trading exchanges, and real estate, among others which helps frame the Australian operating environment.

In addition to cold beverages and delicious food, Australia benefits from a number of enduring structural strengths that set the foundation for attractive long-term investment opportunities. These include abundant land and natural resources, appeal as a place to work and live, and a stable social and political framework that supports capital formation and business confidence.

While not without challenges, notably affordable housing and the ongoing complexities of the U.S.-China trade tensions, these issues do not overshadow the country’s overall economic resilience. After assessing both the opportunities and risks, we feel the economic conditions provide a solid case for continued Australian investment on behalf of our clients.

Australia is far and away the world’s largest producer of iron ore. Additionally, it has meaningful reserves of nickel, lithium, copper, gold, and rare earth elements. This diverse collection of natural resources positions the country to benefit on multiple fronts. Australia can both sell into emerging markets hungry for materials like steel and participate in the global expansion of electrification and the renewable energy build out with lithium and copper.

Underpinning the economy is a very stable banking system. In the latest global rankings of the World’s Safest Banks, Australia’s big four banks all placed in the top 25 (i). The Australian banks take the responsibility of ensuring stability should an economic downturn occur very seriously, and that mindset drives their conservative balance sheet positioning and risk management practices.

We highlight the mining and banking sectors as they remain the core drivers of economic activity. Financials and materials make up 55% of the ASX 200 Index (the flagship stock index in Australia) (ii). The sector composition differs greatly from the S&P 500. The mix of businesses that make up the ASX 200 Index generate a 3.4% dividend yield which is more than three times the S&P 500 at 1.08%. These attributes make Australia attractive for investors seeking reliable income. In addition to the attractive yields, Australia offers domestic investors “franking credits” on dividends which function as a tax credit and raise the after-tax yield of dividends, thus, encouraging domestic stock ownership. Within Australia, resident ownership of domestic stocks is widespread.

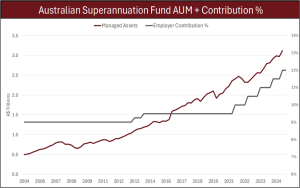

Since the early 1990s, employers in Australia have been required to contribute to employee retirement accounts through a system called Superannuation. Think of a required 401k in the U.S. funded by mandatory and meaningful employer contributions. The contribution rate started at 3% of annual salaries, gradually rose to 9% in the early 2000s, and today stands at 12%. In the chart above, the grey line plots the contribution percentage over time, and the red line is managed assets in trillions. There are an additional trillion dollars of non-managed funds within the Superannuation pool. The result of this policy is Australia has created one of the largest retirement pools per capita in the world with total assets of A$4.3 Trillion. Australia has the 4th most valuable pension system globally while ranking 55th by population(iii).

Despite these robust retirement account balances, home ownership and home equity is the primary lens that Australians view their wealth. With a vast majority of their mortgages being floating rate, changes to interest rates feed through the economy faster than countries like the U.S., where fixed rate mortgages dominate. As a result, monetary policy in Australia has a more immediate impact on consumer spending and discretionary income. With the Reserve Bank of Australia cutting interest rates, consumers are starting to get a bit of relief.

The Superannuation contribution rate is expected to stay at 12%, and in practice this means that every month fresh money pours into the domestic stock market. These funds do invest internationally as well but the volume of contributions directed into domestic equities is significant enough, in our opinion, to meaningfully influence the Australian market. A rising tide lifts all boats…even Down Under.

In addition to elevated contribution, the Superannuation funds now also have more stringent performance testing. In practice this means more domestic funds favor passive investments. As a result of this capital push and passive tilt, the largest companies in Australia have the potential to trade at elevated valuations that can persist for a long period of time as the companies that have large index representations continue to see inflows.

Given these dynamics, we believe active management is a prudent approach as we can then curate selective Australian exposures and not simply go passive and end up owning the companies with the most elevated valuations. We remain committed to our existing Aussie investments and will continue to hunt for more opportunities to invest. If nothing else, we will always go back for the coffee.

i “PRESS RELEASE: Global Finance Names The 100 Safest Banks In The World For 2025.” Global Finance Magazine, 8 Oct. 2025, gfmag.com/award/winner-announcements/press-release- global-finance-names-the-100-safest-banks-in-the-world-for-2025/

ii “S&P/ASX 200.” S&P Dow Jones Indices, S&P Global, www.spglobal.com/spdji/en/indices/equity/sp-asx-200/#overview. Accessed 21 Nov. 2025.

iii “Global Pension System Rankings.” SMC Research Note, Securities and Margin Corporation, 20 Feb. 2025, smcaustralia.com/app/uploads/2025/02/2025-02-20-SMC-Research-Note-Global- Pension-System-Rankings.pdf.

ii “S&P/ASX 200.” S&P Dow Jones Indices, S&P Global, www.spglobal.com/spdji/en/indices/equity/sp-asx-200/#overview. Accessed 21 Nov. 2025.

iii “Global Pension System Rankings.” SMC Research Note, Securities and Margin Corporation, 20 Feb. 2025, smcaustralia.com/app/uploads/2025/02/2025-02-20-SMC-Research-Note-Global- Pension-System-Rankings.pdf.

Disclosures:

The information provided is for educational and informational purposes only and is not intended to be, and should not be interpreted as, recommendations to purchase or sell securities. All investments contain risk and may lose value. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information. Naples Global Advisors, LLC is governed under the Securities and Exchange Commission as an Investment Advisor under the Investment Advisors Act of 1940.