Fourth Quarter 2025 Market Insights

John M. Suddeth, CFA

December 31, 2025

December 31, 2025

“I never met anyone, or heard of anyone, or read of anyone who was successful who was a pessimist. You have to be positive, or you’ll never get anywhere.” – Bill O’Neil, founder of The Investor Business Daily

A favorite movie of mine, and one relatable to our business is The Big Short. As the name implies (it is highly entertaining, even for a movie centered on finance), the plot revolves around several groups of hedge fund managers who successfully, and independently, shorted mortgage bonds during the 2008 housing crisis. Shorting securities involves the sequential order of selling a security in anticipation of a price decline, then buying the security back—a sell high, buy low process. Short selling is generally viewed as an essential component of maintaining orderly markets as the process helps to normalize excesses and to discourage fraud. It is, however, a strategy that incorporates a unique mindset of profiting from a looming crisis, be it broader economic or specific to a particular business. By comparison, a long-only manager (our side of the road) aspires to buy low and sell high, or preferably, hold for the appreciation that should mirror the underlying growth of the business. As a well-recognized investor and newspaper publisher, Bill O’Neil’s rather frankly delivered quote (noted at the top of the page) resonates for us. NGA’s investment process is rooted in optimism, and by extension, lends itself to investing our clients’ capital as a means to support a better tomorrow. The exercise of applying our natural curiosity to see what is working around the world, to look, to learn, and to uncover is remarkably simple yet not so easy to implement. The key point to convey is that while many different investment strategies exist, we have chosen one that embodies optimism as a core tenet, a trait most natural to us.

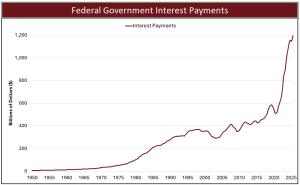

Transitioning to the broader economy, the following chart reflects the interest expense of the U.S. government resulting from the explosion of Treasury debt issuance:

Source: U.S. Bureau of Economic Analysis via FRED

The post-Covid spike after 2020 was a noticeable, and worrisome, inflection point. According to a recent article in The Wall Street Journal, the annual interest expense paid by the U.S. government on its debt exceeded $1 trillion for 2025.(i) That figure, in turn, exceeded the annual appropriation expenditures for defense and homeland security… combined. A logical question that follows is whether it is reasonable

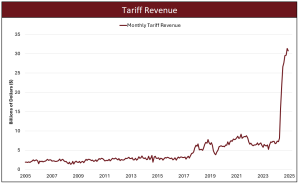

to remain optimistic given the staggering level of U.S. government debt and persistent fiscal deficits? Despite an aversion to debt and wasteful spending (be it government, corporate, or personal) our professional response is one of practical indifference. There are worse offenders with worse debt to GDP metrics (think Japan and Singapore), and we are living and investing in a relative world.(ii) Even with the excessive government debt, Japan and Singapore managed historically stable economies and less than concerning inflation levels. So, while we aren’t convinced that the U.S. inflation level is as benign as the Fed is stating, it seems like those pesky tariffs (which stung the markets in the first quarter of 2025) appear to be lessening the strain. As seen in the following chart, the flood of tariff cash has become handy, bolstering U.S. government’s coffers and supporting the Fed’s dovish posture.

to remain optimistic given the staggering level of U.S. government debt and persistent fiscal deficits? Despite an aversion to debt and wasteful spending (be it government, corporate, or personal) our professional response is one of practical indifference. There are worse offenders with worse debt to GDP metrics (think Japan and Singapore), and we are living and investing in a relative world.(ii) Even with the excessive government debt, Japan and Singapore managed historically stable economies and less than concerning inflation levels. So, while we aren’t convinced that the U.S. inflation level is as benign as the Fed is stating, it seems like those pesky tariffs (which stung the markets in the first quarter of 2025) appear to be lessening the strain. As seen in the following chart, the flood of tariff cash has become handy, bolstering U.S. government’s coffers and supporting the Fed’s dovish posture.

Source: Treasury, Bloomberg

Trying to perfectly connect the frayed pieces of the world’s economic puzzle together can lead to investor frustration. Rather, one should recognize the complexity of cross currents, economic and political among them, which can be seemingly contradictory at times. This includes a U.S. dollar that weakened roughly 10% in the past year, juxtaposed against trillions of dollars committed to AI related capital projects which are helping fuel economic growth.(iii) Ultimately NGA embraces a relative perspective, one that is practical, global, and long tenured.

Speaking of our global approach, we hope you had the chance to read our colleague Wyatt Russo’s recent research piece following his trip to Australia, and the identified favorable trends “Down Under.” My wife and I took a less official trip down the Rhine River in December, reconnecting old friendships and doing our small part to support several European economies. While technically a vacation, my business antennae tend to be perpetually on “alert.” We could see first-hand the commitment to travel from the 65-plus crowd all around us, which, according to the U.S. Bureau of Labor statistics, is projected to reach a new high in the U.S. starting in 2026.(iv) This bulging bracket of Medicare aged retirees has economic, political, and investment implications. Medical and pharmaceutical services appear as direct beneficiaries, with transportation, food/beverage, insurance (property, travel, annuities and pet insurance), along with wealth management, all appearing with investable considerations. Revenue expansion across various companies within these sectors should be on display in the coming years.

Organizationally, we wanted to share a few positive firm updates around staff additions. We recently welcomed a new client advisor associate, Meri Strapp. Meri joined us from Bank of America and is serving a critical support role. Additionally, we are excited to be adding Matt Oleksak in a senior client advisory role, beginning in January. Matt is joining us from Brighthouse Financial, has earned the CFP® certification, and brings to us a strong blend of financial and organizational skills. We look forward to making introductions to our two newest colleagues in the months ahead.

In a nod to forward planning, after nearly 15 years on 5th Avenue South, we have made the necessary decision to move our office location. While no easy task in downtown Naples, Michael and Wyatt worked tirelessly to secure a long-term lease for an entire top floor of a standalone building just a few blocks away on 3rd Avenue South. The new location is just across from the CVS in the building housing Seacoast Bank (856 3rd Avenue South). With our firm’s Naples staff now at 16, and as our AUM approaches $2 billion, the new location provides room for further staff expansion, as well as dedicated client parking, all while remaining downtown. Our target date for the move is late spring 2026, and we plan to share additional details as the transition plan is finalized.

With key new staff additions, a bit of wind behind our backs from favorable financial markets, a pending new office location, and layered generational leadership firmly in place, there is a great deal happening at NGA that is cause for optimism and excitement. We are grateful to be of service to you, our client families, and genuinely thankful for the continued trust and confidence.

i The Wall Street Journal,12.16.25, Will Bonds Squeeze U.S. Middle Class, Spencer Jakab

ii The Wall Street Journal, 12.1.25, Look Abroad for Clues on U.S. Debt, Streetwise by James Mackintosh

iii www.Gartner.com/en/newsroom/press-releases 9.17.25 “Worldwide AI Spending will Total $1.5 trillion in 2025”

iv US Bureau of Labor Statistics, as presented by m365 Copilot

ii The Wall Street Journal, 12.1.25, Look Abroad for Clues on U.S. Debt, Streetwise by James Mackintosh

iii www.Gartner.com/en/newsroom/press-releases 9.17.25 “Worldwide AI Spending will Total $1.5 trillion in 2025”

iv US Bureau of Labor Statistics, as presented by m365 Copilot

The views expressed in this material are the views of Naples Global Advisors, LLC through 12/31/2025. The views are subject to change based on market and other conditions. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. The information provided is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations to purchase or sell securities. Naples Global Advisors, LLC is governed under the Securities and Exchange Commission as an Investment Advisor under the Investment Advisors Act of 1940. All investments contain risk and may lose value.