Third Quarter 2025 Market Insights

Wyatt Russo, CFA

September 30, 2025

September 30, 2025

“Buying back shares is the simplest and best way a company can reward its investors. If a company has faith in its own future, then why shouldn’t it invest in itself, just as the shareholders do?” – Peter Lynch

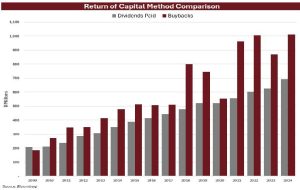

With an endless barrage of headlines highlighting geopolitical turmoil, tariffs, and inflation driving the daily news cycle, it can be easy to overlook the rise of stock buybacks as an increasingly important market driver. Buybacks of U.S. stocks are expected to close the year at their highest level ever at over $1.1 trillion with a T (i). For decades dividends exceeded stock buybacks, but recently the preference for buybacks has increased dramatically.

There are a few reasons behind this shift. When companies pay a dividend, cash-flow-minded investors expect a commitment to paying that dividend, whereas buybacks provide management with flexibility to adjust their capital allocation plan more freely. The buyback spike starting in 2018 can be partially attributed to the Tax Cuts and Jobs Act, which reduced the corporate tax rate and thus provided additional retained earnings to purchase shares. Buybacks have historically served as a signal that management believes their stock is attractive. This notion has proven itself over time as the S&P 500 buyback index has outperformed the traditional S&P index by 2% per year over the last 30 years (ii). Buybacks have the benefit of not generating a taxable event for investors as no cash is received, which makes for a tax efficient method of “returning” capital to shareholders. A buyback is a better option than overpaying for an acquisition or funding projects that do not meet return hurdle rates. Conversely, the rise in buybacks could signal that the opportunity to deploy capital towards attractive longer-term initiatives is limited. Many companies with large buyback programs are buying back stock to offset dilution from significant stock-based compensation plans. NGA cares about the net reduction of shares outstanding, not just offsetting dilution. In a world where buybacks are large and set to rise, simply looking at dividend yield does not tell the whole shareholder yield story.

Viewed independently, buybacks are neither good nor bad. Buybacks are a tool for capital allocation – price matters when deciding whether to buy back stock. Ideally, we are looking for a “trifecta” from our companies where they are investing sufficiently in capital expenditure and research and development, maintaining a commitment to their dividend, and opportunistically leveraging buybacks as an additional arrow in the quiver. Among others, a financial services company offering credit cards in which NGA invests has delivered on this trifecta over time, and shareholders have been rewarded handsomely.

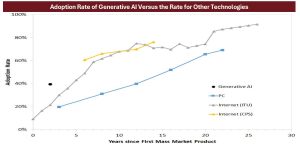

Beyond the technical reasons previously cited, a reasonable question would be why has this buyback pace accelerated of late? Many companies with large buyback programs today are the tech giants riding the artificial intelligence (AI) tidal wave. While buybacks may not be top of mind, there is a massive spotlight on AI. We are amid an AI discovery rush and are experiencing it first-hand. The following chart highlights the adoption rate of AI versus adoption rates of other groundbreaking technologies. While we are admittedly in the early innings, AI has very quickly reached a 40% adoption rate (iii). This initial pace has exceeded the adoption rate of first few years of the internet and personal computers. It is hard to overstate how fast AI has taken the world by storm. The slope, or subsequent speed of adoption, has yet to be determined but it is an incredible start.

AI related companies have benefited from tremendous growth, strong balance sheets, and significantly increasing cash flow generation. This AI-driven earnings surge gives these companies extraordinary amounts of financial resources. However, the opportunity comes with added complexity as these tech companies face a balancing act between more immediate shareholder returns and investment in future growth through capital expenditure. Collective spending on chips, cloud computing infrastructure, and related technologies is positioned to exceed a trillion dollars over the coming years, even as these same companies continue tremendous share repurchase programs. The scale of spending is unprecedented and partially explains the economic resilience enjoyed despite the turmoil in daily headlines.

Within our client portfolios, we’re casting a wide net beyond just the beneficiaries of the initial AI excitement. While we maintain positions in subsectors like chip designers and manufacturers, we’re equally focused on identifying second and third-order participants in these trends, which include companies providing essential infrastructure: fiber optic connectivity, nuclear energy for power-intensive data centers, and specialized electrical components providers.

We are living and breathing the artificial intelligence expansion in NGA portfolio companies as well as in our internal research methods. Our investment team is leveraging artificial intelligence to supplement our research, and we are seeing meaningful usage across the team. While AI is additive and will lead to efficiency gains, our view is that the human knowledge to effectively use these capabilities and to make decisions based on the output will remain a critical part of our investment process. Creating thoughtful prompts, interpreting results, and understanding model specific strengths and weaknesses will be skillsets that allow our team to effectively leverage these rapidly evolving tools.

AI has the potential to assist with analysis and rapid collection of information, but errors do occur, and the output is currently viewed as a helpful reference prior to additional due diligence. NGA portfolio managers still make one hundred percent of our investment decisions. We do not outsource or defer to AI, but we believe adopting these tools has become a valuable supporting component of our research, analysis, and portfolio management processes.

On the bond side of the ledger, I had the privilege of writing our quarterly note this time last year when the Federal Reserve had just cut interest rates, and they just did again. Guess the team should hand me the pen anytime we would like a rate cut…All kidding aside, given additional forecasted rate cuts and tight credit spreads, the team has been focused on locking in yields and moving up in quality across a variety of fixed income sub-asset classes. We believe the current yields available present a compelling return opportunity, and the bonds we are buying today serve a valuable purpose within portfolios for the years to come.

Lastly, our commitment to international investing has proved valuable on the year as non-domestic holdings have generally been additive to returns. We are making the long trek to Australia later this month to meet with management teams to explore local opportunities. We look forward to sharing our takeaways from our time down under.

i Hur, Krystal “American Companies Are Buying Their Own Stocks at a Record Pace.” The Wall Street Journal, 11 Aug.2025, www.wsj.com/finance/stocks/stock-buybacks-2025-3b0ddedd

ii Sources: Bloomberg; S&P Indices

iii Bick, Alexander, Adam Blandin, and David Deming. “The Rapid Adoption of Generative AI.” St. Louis Fed, On the Economy, 23 Sept. 2024,

https://www.stlouisfed.org/on-the-economy/2024/sep/rapid-adoption-generative-ai

ii Sources: Bloomberg; S&P Indices

iii Bick, Alexander, Adam Blandin, and David Deming. “The Rapid Adoption of Generative AI.” St. Louis Fed, On the Economy, 23 Sept. 2024,

https://www.stlouisfed.org/on-the-economy/2024/sep/rapid-adoption-generative-ai

The views expressed in this material are the views of Naples Global Advisors, LLC through 9/30/2025. The views are subject to change based on market and other conditions. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. The information provided is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations to purchase or sell securities. Naples Global Advisors, LLC is governed under the Securities and Exchange Commission as an Investment Advisor under the Investment Advisors Act of 1940. All investments contain risk and may lose value.