Isaac Codrey, CFA

In an annual gathering of top economists for the American Economic Association earlier this year, Yellen made a speech in which she once again reiterated, “I don’t think expansions just die of old age.” Her predecessor, Ben Bernanke, followed up on stage with, “I like to say they get murdered.” It was a witty response that was perfectly tailored to their industry peers. In the end, both Yellen and Bernanke were making the same point – You can’t have the effect without the cause. Something must tip the scales and drive an economy from expansion to contraction. There must be a trigger, a catalyst, a cause.

Throughout this recovery, there have been numerous potential flash warnings: European sovereign crisis in 2011- 2012, China slowdown in 2015, oil patch oversupply in late-2015/early-2016, Brexit in late-2016. In the end, all of them were fleeting with the U.S. economy plowing through those potential roadblocks as if they were mere speedbumps.

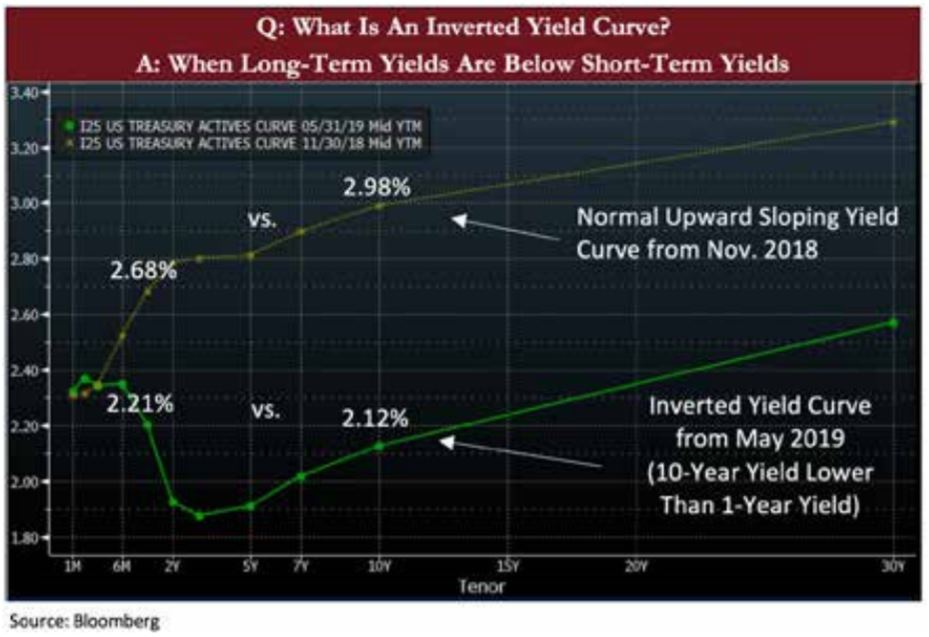

Fast forward to today… The odds of a recession occurring in the next twelve months are at 30% according to economists surveyed by Bloomberg. These odds don’t sound too alarming, but they are at the highest levels since the European sovereign crisis erupted earlier this decade. What is perhaps more ominous has been the action in fixed income markets, where investors have flocked to U.S. Treasuries in search of safety. As a result, long-term yields have been driven notably lower; so low that long-term yields fell below short-term yields. (Note: That safe-haven demand has translated into great total returns for the bond portion of client portfolios thus far in 2019). In financial parlance, the yield curve “inverted.” This has captivated the financial media, and rightfully so. An inverted yield curve has preceded a recession 100% of the time. (Admittedly, not all inverted yield curves have preceded recessions so there have been a few false positives.)

Our purpose of highlighting the increasing possibility of a recession, even if still remote, is not to make a call on whether there will be a recession in the next twelve months or define new tactics we intend to take. Nor is it our goal to make our clients worry. Rather, it is to provide comfort in the case that this possibility does indeed become reality.

What is certain is that the U.S. economy will go through a recession again. Economies are cyclical. That is a fact of life. What we also know is that historically recessions are short in nature. Since the 1950s, the average recession has lasted slightly less than a year while the average expansion persisted six and half years. More importantly, the average economic decline in a recession is just 1.5% whereas the average economic growth is nearly 25% in an expansion. The same laws generally apply to bull (up) and bear (down) equity markets. The length and magnitude are greater for bull markets versus bear markets. The global economy and stock markets are biased towards growth for several different reasons: population growth, capitalism, and innovation to a name a few. The historical data bears this out and we subscribe to this optimism looking forward. Ultimately, this is one of the major reasons we believe a short-term macroeconomic call (good or bad) is of very little relevance in managing our client’s long-term wealth. In the end, it is always better to take the long view.

We were recently reminded of our bias towards “long term optimism” when reading about memory chips. No, we are not talking about the typical semiconductor chips technology companies produce to store data in devices such as cell phones and computers. We are talking about actual human memory chips. Devices that are placed onto and into the brain of humans that can boost memory by as much as 37% according to a recent study. Admittedly still in the beginning stages, the implications and future uses are nevertheless profound. The first to use the prosthetics would likely be the hundreds of thousands of military personnel that have suffered traumatic brain injuries. And next would be those who have suffered from strokes or who are dealing with Alzheimer’s. The procedure is currently too invasive for broad usage. Indeed, not many would undergo brain surgery so that they can better remember where their keys are or where they parked the car. But we like to let our minds wander into the future, and it doesn’t seem out of this realm that one day the surgery would be less or even noninvasive. Ultimately, many of the companies you own are producing these types of new innovative technologies and we think it would be unwise to sell out of their stock because of a short-term prediction on the direction of the economy and stock market.

Remaining disciplined with an eye towards the long-term is easier to say than do. We remember how painful the last recession was economically, emotionally, and financially. In our opinion, the best medicine for that type of pain remains diversification via asset allocation. As we like to stress, our clients should not be taking more risk than necessary to meet their goals. If you would like to discuss your portfolio asset allocation or feel your risk tolerance may be misaligned, we invite you to come in or call for a check-up.