Jason R. Rundorff, CFP®

October 20, 2022

In a year where we’ve witnessed catastrophic hurricanes, high inflation, and financial market turmoil, there is some welcome relief on the horizon courtesy of the Internal Revenue Service (IRS). Last week, the IRS announced the inflation adjusted 2023 annual limits for a variety of tax matters.

For The Tax Conscious:

- The annual gift tax exclusion increases to $17,000 from $16,000

- The unified lifetime estate and gift tax exclusion climbs from $12.06 million to $12.92 million per individual (however, this elevated amount is set to sunset in 2026)

- The standard deduction receives a 7% increase to $27,700 for those married and filing jointly and $13,850 for single filers

- The top capital gains bracket (20% tax rate) moves to $553,851 or more, up from plus $517,200 for those married filing jointly, and the 15% bracket expands to a range of $89,250 – $553,850

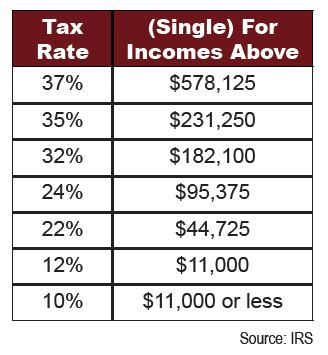

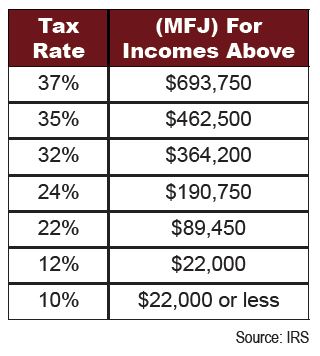

- Other changes include increases to the tax brackets across all marginal levels (see table for single filers and married filing jointly)

For The Savers:

- IRA contribution limit rises from $6,000 to $6,500 after being static since 2019 (age 50+ catch-up contribution remains at $1,000)

- 401(k) employee contribution limit jumps to $22,500 (the $2,000 increase is the largest dollar and percentage increase in history)

- The total contribution limit for 401(k) and SEP plans increases $5,000 to $66,000

- For those aged 50+, the total 401(k) plan contribution limit from all sources (employee, employer, profit sharing) increases to $73,500, including the $7,500 catch-up contribution