Reporting by Greg Debski, CFA

How do you eat an elephant? One bite at a time. And while we’re not actually advocating for elephant steaks, the concept of approaching a monumental issue in small manageable pieces is how we can make sense of the fresh turmoil currently at our doorstep. The issues at hand are just that—monumental—but our objective is to successfully navigate towards the potential outcomes of those issues, not to solve them or to guess what will happen.

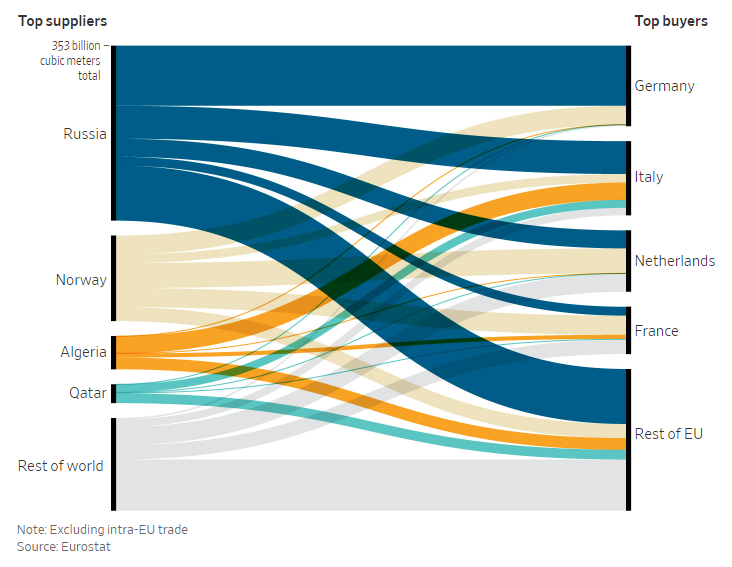

The impacts on markets and businesses from the war in Ukraine can essentially be broken into three categories: physical impacts, globally “direct” impacts, and globally “indirect” impacts. For investors, avoiding the physical impact of war is relatively simple—don’t invest in companies with assets or operations in the areas facing conflict. Between the strict fundamental constrains we use before considering a company for investment, and the on-site visits to our more “off the beaten path” targets, our investment opinions of both Russia and Ukraine have never really improved from “thanks, but no thanks.” Even before the current conflict, a healthy dose of persistent corruption in both countries kept us from participating in the regions. An ounce of prevention is worth a pound of cure.

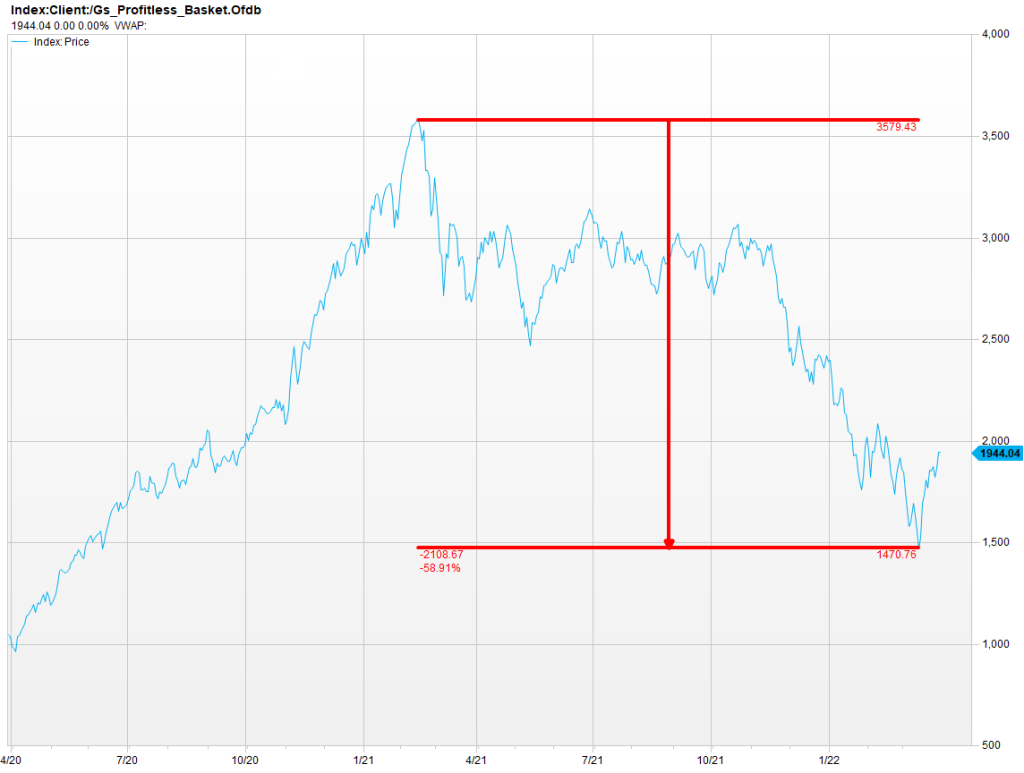

How have we prepared for inflation and tectonic shifts in global funding markets? One bite at a time! Short durations in our bond portfolios and a broad ownership of coupon-paying (cash flowing) bonds have been key tools in mitigating the risk posed by quickly rising interest rates. Additionally, our long-standing practice of owning mostly individual bonds means that we know when cash will be returned from bond maturities, allowing us to reinvest those proceeds at higher and rising rates. A key component of our equity due diligence is avoiding heavily indebted companies since their refinancing costs will increase dramatically as a result of higher interest rates. Finally, a terrific side effect of our low-debt, value-focused approach to equities is that those cash-flowing, shock-resistant businesses have a habit of raising their dividend payments. On average, our top 20 equity holdings have increased their dividend payments by 11% annually over the last 3 years, and by 15% annually over the last 5 years! We expect the trend of dividend increases to continue, and those increases should go a long way in helping to offset the impacts of inflation.

We cannot predict the shocks or the outcomes. We can only discipline our analysis to uncover and purchase securities we think are truly durable and more than likely to withstand this or any other crisis de jour. That disciplined analysis with due diligence is exactly what we have done for our clients, and exactly what we will continue to do for our clients—one bite at a time.