Reporting by Isaac Codrey, CFA

Resiliency in the Face of a Storm

That’s a lot of negativity, yet we find ourselves feeling quite sanguine. Not because we know this macroeconomic hurricane will avoid landfall. No, it’s because we know that we built the house to withstand hurricane force winds. So, we wanted to take this opportunity to provide a general refresher of what you own and why you own it, which will hopefully result in some measure of comfort through these and future economic storms.

In simplistic terms, if you own a bond, you have lent money to a government or corporate entity and in return, they are paying you interest. At the end of the term, they return the money you lent them. Therefore, bonds have a dual purpose of income and relative stability of principal.

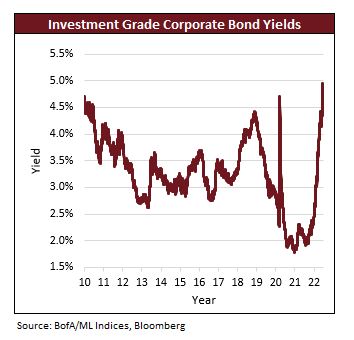

However, as we have been acutely reminded this year, prices of bonds can decline. In fact, in 2022 the bond markets have posted their worst start to a year on record (data starts in 1978). So why do we feel so good about your bond holdings? For the first time in more than a decade the scale is starting to tilt in favor of the saver rather than the borrower. Remember in 2020 when Austria issued 100-year bonds at an astoundingly low 0.88% yield? That was definitely in favor of the borrower, not the saver. It was quite indicative of how bond investors were starved for yield in recent years. Well, the paradigm is shifting.

Equities

In simplistic terms, if you own a stock, you have invested money into a company in return for an ownership stake of its future cash flows (earnings). The stocks that we own have a dual objective of capital appreciation and income.

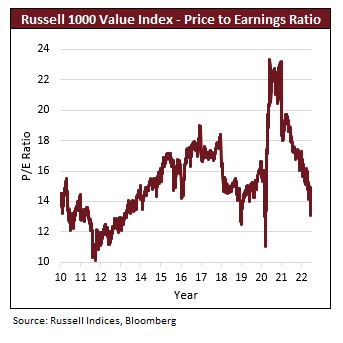

In particular, NGA’s equity investment philosophy calls for the companies in which we invest to have growing cash flows, for the price of the stock to trade at a discount to our perceived value of the company, and for the company to share its cash flows with its shareholders in the form of a dividend. The first two criteria drive capital appreciation, and the final criteria is the income part of the equation.

Growth: The companies in which we invest have generally experienced rising demand for their products and/or services over the last decade, highlighted by a history of sales and earnings growth. On average, NGA portfolio companies have reported 12% annual earnings expansion over the last five years (which includes a recessionary period). More importantly, we expect them to continue to experience improving demand. Analysts are currently projecting 8% average annual earnings growth the next three years. Admittedly, analysts are rarely 100% correct in their estimates, but a lot of bad stuff (our technical term) has to happen before the revenues of these closely vetted companies flatline, let alone decline. There is a resiliency in NGA portfolio companies’ expansion stories due to their in-demand products/services, healthy margins, and strong balance sheets. As a result, we have great confidence the companies in which we invest will be able to weather the inevitable economic storms, just as they did in 2020 and 2008/09. While values go up and down over the short-term, we are optimistic about NGA portfolio companies continuing to expand their cash flows, which is the ultimate driver of longer-term stock price appreciation.

So, while the year-to-date returns may not be pretty and markets may not be enjoyable for the next several months, it is important to keep a few things in mind. First, we have had successive years of higher than the average returns (it’s easy to forget the +10% returns of 2019, 2020 and 2021). Second, but equally as important, your NGA portfolio is comprised of high-quality bonds and stocks backed by very sound investment rationale. What a great roadmap to consistently achieving your investment goals—regardless of brewing macroeconomic storms. After all, if a hurricane were barreling down on Florida, you wouldn’t uproot your house and move it out of the potential “cone.” Similarly, if a recession were barreling down on the global economy, you shouldn’t uproot your investment portfolios in panic. Rather, take comfort in knowing what you own and why you own it. Ultimately, you would remain resilient in both scenarios, knowing there are sunny days ahead!