Reporting by John M. Suddeth Jr., CFA

- Business has entrenched interests and a critical role in the U.S. election process. The linkage serves as a self-correcting mechanism, as politicians may threaten the hand that feeds them, but actually biting the hand is another matter.

- We invest as a political agnostic. Political winds are always blowing here and abroad. Be it for congress, governorships, school boards, or the presidency, political races are perpetually in play and on display. Yes, vote with the fullness of your patriotic fervor, but invest pragmatically.

- Odds are favorable for the financial markets in 2024. Since 1964, the S&P 500 Index has averaged 9.2% in the year leading into the election, with 14 of 15 periods delivering gains (2008 was the exception).* Cash is in motion during presidential election years, Federal Reserve Boards are cautious, and historically, those financial factors translate into supportive economic activity.

- Be mindful that our firm is highly experienced in navigating the global playing field. We have had our boots on the ground in every country represented in our portfolios, over 30 country visits at last count, and our level of resulting comfortability in the available financial arsenal (from sovereign debt to currencies to gold and oil) is meaningful and value adding.

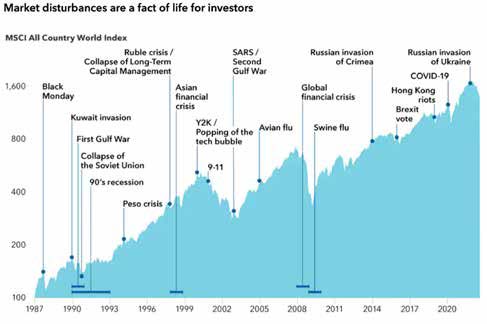

- Finally, with your safety valves in place (zero debt, 3-6 months of emergency liquidity), invest like there will be a tomorrow. So far, the world has kept turning, and betting against the equity markets (per the multi decade chart below) or trying to “sit out” the inevitable crisis has been a long-term disappointment.

Sources: MSCI, RIMES. As of 6/30/22. Data is indexed to 100 on 1/1/87, based on the MSCI World Index from 1/1/87-12/31/87, the MSCI ACWI with gross returns from 1/1/88-12/31/00, and the MSCI ACWI with net returns thereafter.

At the portfolio level, we are once again enjoying the balance afforded with a multi-asset approach using stocks, bonds, and other instruments. Strains from the severe interest rate hikes in 2022 and 2023 have subsided, and bonds are providing attractive and stable yields. We see this trend extending into 2024, offering a continuation of normalized lending opportunities. Yes, Fed adjustments appear imminent, but our view is they should be modest and thoughtfully paced as inflation stages into a higher resting heart rate. Our rationale also incorporates the $30 trillion of absolute U.S. debt, and the related $659 billion of net interest payments this last fiscal year. The competing supply and demand imbalance should work as an offset to any Federal Reserve monetary policy easing. Spreads within the various credit segments will be jostled around but still supportive of a healthy appetite for debt securities: corporate, agency, municipal, high yield, sovereign, and preferred stocks. Debt has returned to its supporting role in the risk/reward profile for our portfolios.

As for stocks, election year statistics notwithstanding, we are upbeat as the train of earnings and dividend growth keeps chugging along. Within our roster of companies, the average dividend increase in 2023 was just above 8%. More broadly, and notably outside the “magnificent 7” stocks, we are seeing compelling valuations down the capitalization spectrum (midcap to micro-cap) and within foreign markets. And, as noted from our recent travel report, we like the greater southeast Asian regional story (India to Indonesia) as a natural opportunity while China stumbles trying to get its economic train back on track.

As an Atlanta resident in the early 90s, the term “spaghetti junction” was commonly used to describe the mass of highway overpasses being built around the city. The Atlanta traffic scenes were often chaotic, loaded with nightly workers and orange traffic cones; it was difficult to envision when it would end. Yet, the overpasses were completed, and the result has been decades of economic boost to the Georgia economy. India today bears similarities, but at a significantly broader scale. According to Bloomberg Markets,** India has spent $120 billion on improving infrastructure in the last fiscal year, a 30% increase from the prior year. New highway construction nearly doubled from 49,000 miles 10 years ago to 90,000 miles in 2023. As an efficiency example, a new rail freight corridor from Mumbai to New Delhi is expected to cut shipping for the 870-mile trip to 14 hours from 14 days. At over 1.4 billion, India’s population has surpassed China and is rapidly consuming cement, iron, and other commodities previously thought to be earmarked for China. As the statistics bear witness there are bold new guests at the world’s economic dinner table, and they aren’t speaking Mandarin.

As a history buff, a favorite read of mine for 2023 was The Wager, by David Grann. The story centers around a British war ship rounding Cape Horn in the 1740s, and the daily peril the sailors faced in their search for wealth, and ultimately basic survival. The book details the mundane daily life for the sailors, and as a means of directional guidance, and often in the nastiest of weather, sailors would climb to the crow’s nest, 100 feet atop a mast. They had to manage themselves over the rolling ship, and report down what they could see on the horizon, be it land, shifting shoals, or even pirates. Instruments were available but there was no substitute for the visual confidence afforded from the crow’s nest. In a similar manner, our in-person research trips, most recently to Japan and then to Southeast Asia, afford us a comparable view. Yes, these can be long, complicated (translators, visas, the occasional grouping of immunization shots), and pricey trips, but our research trips provide clarity and confidence as we look for thoughtful ways to deploy client capital.

Charlie Munger was asked many times about the “secret” of his investment success. He wryly noted, “there isn’t a single formula. You need to know a lot about business and human nature and the numbers… It is unreasonable to expect that there is a magic system that will do it for you.”*** We see that as sage advice, in particular from a 99-year-old multibillionaire who had seen a thing or two in his many business days. To that end, we know the human nature of an election year will bring market punches, and also open numerous opportunities. As we step into what is sure to be an exciting 2024, our strategy is to keep a pragmatic eye on the center line of the investment road, remaining vigilant in what is an easily fractured world. We hope you will take comfort in knowing we are in the crow’s nest and fully engaged with the global investing landscape.

*The Wall Street Journal, 11.3. 2023 Politics and Markets, The Financial Markets and Presidential Elections

**Bloomberg Markets, Menaka Doshi, 9.5.23 India is Spending Billions on Bridges and Roads to outrun China

***Bloomberg News, Katherine Chiglinsky, 11.28.23 “A Master of One Liners: Munger on Politics, Life and Crypto